Mon-Fri, 9:00-17:00 (Beijing Time, UTC+8)

Mon-Fri, 9:00-17:00 (Beijing Time, UTC+8)Frontier Insights

We are dedicated to advancing the technology industry and sharing expertise in technical, business, and cultural domains.

We are dedicated to advancing the technology industry and sharing expertise in technical, business, and cultural domains.

Digital Transformation and Innovation in Fintech Empowerment

Technology Reshaping a New Ecosystem of Financial Services

Under the wave of the digital economy, technology empowerment in finance has become the core driving force for industry development. From mobile payments to digital RMB, from open banking to intelligent risk control, fintech is reshaping traditional financial service models at an unprecedented speed, bringing users more convenient, secure, and personalized financial experiences.

Auto Finance, as an important part of consumer finance, shows great potential in digital transformation. With the continuous growth of vehicle ownership, consumers have increasing demands for convenient, transparent, and efficient car loan services. Traditional offline processing modes can no longer meet user expectations.

Dragon Bravo Corporation Fintech Innovation Practice

Dragon Bravo Corporation, as a professional software technology service provider, has been deeply involved in the fintech field for many years, committed to empowering finance through technology to provide digital transformation solutions for Fortune 500 enterprises. Based on rich industry experience and technical accumulation, we have achieved remarkable results in the digital service of auto finance.

Customer WeChat: Innovation in Car Loan Services within the WeChat Ecosystem

Project Background and User Pain Points

A well-known Fortune 500 automobile manufacturer faced multiple challenges in traditional car loan services: cumbersome user processing procedures, inconvenient information inquiries, heavy customer service pressure, high operational costs, and limited offline services, urgently needing to build an online financial service system.

The Dragon Bravo Corporation team deeply analyzed changes in user behavior and found that modern consumers are accustomed to one-stop mobile service experiences and are unwilling to download additional apps for single functions. They prefer to complete financial services within the familiar WeChat ecosystem.

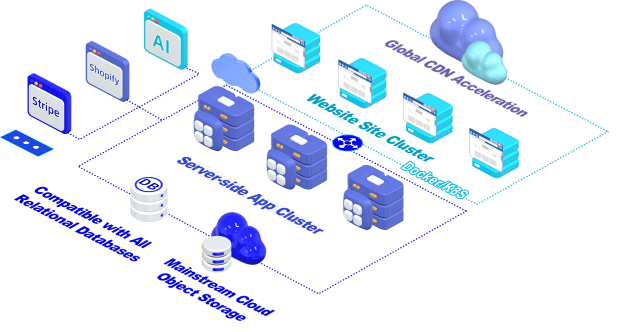

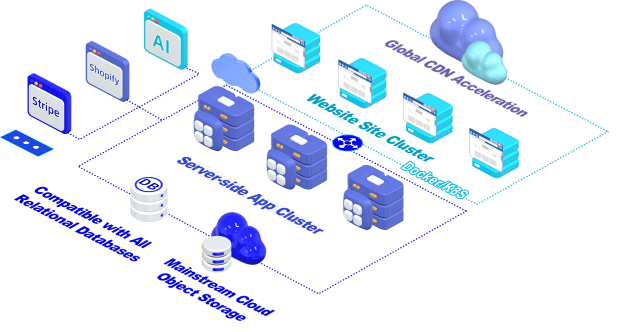

Technical Architecture and Functional Innovation

Based on the official WeChat public account platform, the Dragon Bravo Corporation team built a lightweight car loan service ecosystem:

Core Functional Modules:

· Intelligent Identity Verification: Dual verification via mobile phone number + ID card to ensure account security

· Real-time Loan Management: Integrated contract inquiry, repayment tracking, and date reminders

· Intelligent Calculation Engine: Personalized loan plan recommendations with optimal strategy matching

· Deferred Repayment Service: Special response to pandemic-related needs, demonstrating corporate social responsibility

Technical Highlights:

· High Concurrency Support: Supports hundreds of thousands of users online simultaneously, handling peak traffic steadily

· Second-level Response: Supports large concurrent user access shortly after push content is released

· Full Process Digitization: Complete online service loop from application to loan settlement

Digital Transformation Outcomes and Value Creation

User Experience Innovation

Convenient Service Upgrades:

· Query loan information anytime, anywhere without telephone consultation

· Intelligent repayment reminders to avoid credit risks

· Online loan settlement certificate download, eliminating mailing wait times

· One-click participation in promotional activities to enjoy exclusive benefits

Enterprise Operational Efficiency Improvement

Customer Service Efficiency Optimization: Traditional phone customer service shifted to intelligent mass push notifications, significantly increasing the number of users reached per contact, greatly reducing labor costs while simultaneously improving user response rates and satisfaction.

Precision Marketing Implementation: Through user behavior data analysis, achieve precise user profiling and tagged management, targeted push of personalized financial products, effectively enhancing conversion rates and brand trust.

Project Implementation Methodology: From Challenges to Breakthroughs

Agile Development and Responsive Requirements

Yin Fei — Senior Project Management Expert, Dragon Bravo Corporation

This project is a typical case of technology empowering finance. Facing rapidly changing client demands and urgent delivery timelines, the Dragon Bravo Corporation team demonstrated outstanding professional capability:

· Agile Requirement Response: Establishing a rapid iteration mechanism to timely adjust product functions

· Technical Architecture Optimization: Adopting microservice architecture to ensure system stability and scalability

· Efficient Team Collaboration: Close cross-department cooperation to achieve flawless delivery from scratch

The project was successfully launched in a short period and has maintained continuous functional iteration and performance optimization, providing users with an outstanding digital financial service experience.

Continuous Innovation Technology Path

With the maturity and application of emerging technologies such as blockchain, artificial intelligence, and big data, the Dragon Bravo Corporation team continues to explore fintech empowerment practices:

· Intelligent Risk Control System: Credit evaluation models based on big data analytics

· Blockchain Application: Enhancing transaction transparency and data security

· AI Customer Service Upgrade: Natural language processing technology to optimize user interaction experience

• Future Outlook: Building an Inclusive Financial New Ecosystem

Technology Innovation Driving Industry Transformation

The essence of technology empowering finance lies in lowering service thresholds, improving service efficiency, and realizing inclusive and shared financial services through technological innovation. Dragon Bravo Corporation consistently adheres to the corporate value of "innovation empowerment," committed to maximizing the excellence of financial services through technological means.

Continuously Deepening Fintech Practices

• Looking ahead, the Dragon Bravo Corporation team will continue to deepen innovative practices in fintech:

· Expanding service scenarios: extending from auto finance to more consumer finance scenarios

· Upgrading technical capabilities: integrating the latest technological achievements to enhance service intelligence

· Ecological Cooperation and Win-win: collaborating with more financial institutions and technology enterprises to build a digital financial ecosystem together

We believe that through continuous technological innovation and product optimization, technology empowerment in finance will bring more users convenient, secure, and efficient financial service experiences, promoting the entire industry towards a more inclusive, open, and intelligent direction.

Want to know more about our products?

With years serving Fortune 500 clients, we offer flexible solutions and integrated implementation.

Want to know more about our products?

Xiaohongshu

WeChat Channels

Douyin

Xiaohongshu

WeChat Channels

Douyin

To enhance your browsing experience, analyze website traffic, and optimize our services, we use cookies. By continuing to browse this website, you agree to our use of cookies. For more information, please read our Privacy Policy and Terms of Use.

To enhance your browsing experience, analyze website traffic, and optimize our services, we use cookies. By continuing to browse this website, you agree to our use of cookies. For more information, please read our Privacy Policy and Terms of Use.